Guangzhou (JLC), June 30, 2025--China's manufacturing purchasing managers' index (PMI) rose in June, indicating that the factory activity strengthened for a second consecutive month, according to data from the National Bureau of Statistics (NBS).

The manufacturing PMI came in at 49.7% in June, up by 0.2 percentage points from the previous month, the NBS data shows.

The growth was mainly ascribed to stronger demand and faster production in sectors including food, wine, beverages, refined tea, and specialized equipment, said Zhao Qinghe, a senior statistician of the NBS.

A breakdown of June's manufacturing PMI showed that the sub-index for production stood at 51.0%, up by 0.3 percentage points month on month, signaling that the production activity sped up.

The sub-index for new orders increased to 50.2% in June, up 0.4 percentage points from May, showing a pickup in the market demand, the NBS data shows.

Meanwhile, the sub-index for raw material inventories stood at 48.0%, up by 0.6 percentage points from a month earlier. Despite a month-on-month rise, the sub-index was still in contraction territory.

By contrast, the sub-index for employment slipped to 47.9% in June, down 0.2 percentage points from a month earlier.

The sub-index for distributor delivery time settled at 50.2% in June, up 0.2 percentage points month on month, indicating faster delivery of raw material.

Non-manufacturing index also expands

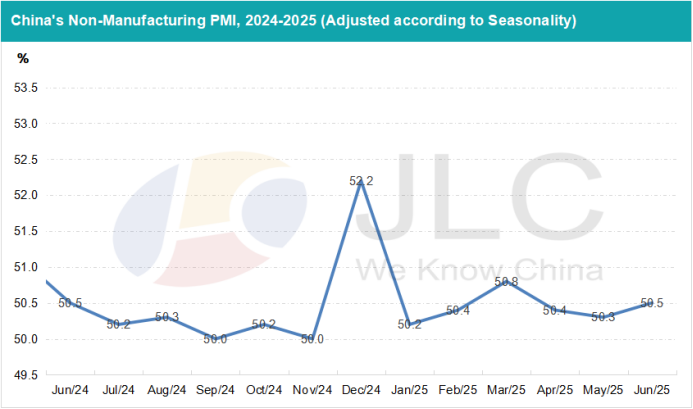

China's non-manufacturing commercial index, which includes sub-indexes for activity in the service and construction sectors, rose to 50.5% in June, up by 0.2 percentage points from May, the NBS data shows.

The construction commercial activity index stood at 52.8% in the month, growing by 1.8 percentage points month on month, while the commercial activity index for services settled at 50.1%, a dip of 0.1 percentage points from the prior month, the NBS data indicates.

The commercial activity indexes for postal services, broadcasting and television, satellite transmission services, Internet software and information technology services, monetary and financial services, capital market services, and insurance were above 55% in June, suggesting relatively high prosperity for these sectors. However, the indexes for retail, road transportation, air transportation, accommodation, catering, and real estate were below the critical point.