2020-2022 were the three years when China's PDH market grew rapidly, following healthy PDH margins in the previous years. As of 2022, about half of the imported LPG in China was consumed by chemical sector, among which, PDH units accounted for the lion’s share.

These three years were also eventful ones: the COVID epidemic from 2020, “dual control” of energy consumption from 2021, and soaring energy prices amid Russia-Ukraine conflict in 2022. On the other hand, demand for propane rose significantly as a large number of new PDH units came on stream. PDH market stood severe tests in the past three years amid a mix of factors. Margins were far lower compared with the previous years.

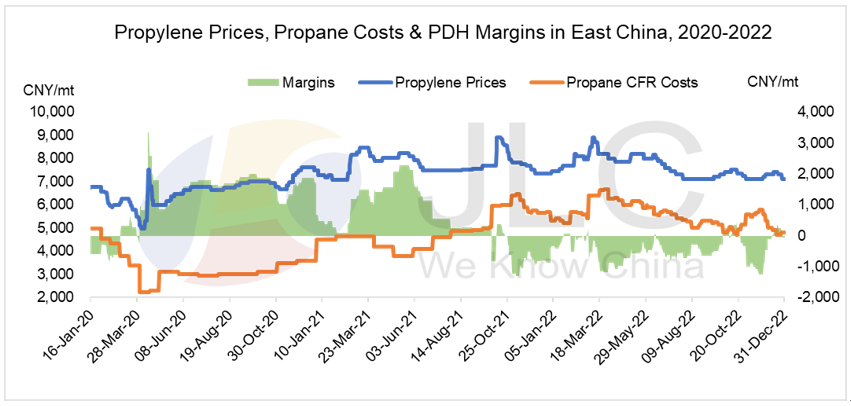

Let’s take a look back at the PDH market in the past three years. Since over 60% of China's PDH units were located in East China, JLC hereby takes the region as an example:

Margins of PDH units were closely related to the cost of feedstock and the prices of end-products, the chart shows. Prior to Q3 2021, margins were positive when differentials between propylene and imported propane were above CNY3,000 /mt, and were negative when the spread was under CNY3,000/mt, as the chart indicates.

The following is a detailed analysis on China's PDH market over the past three years, mainly involving total feedstock demand from PDH units, their operating rates and profitability.

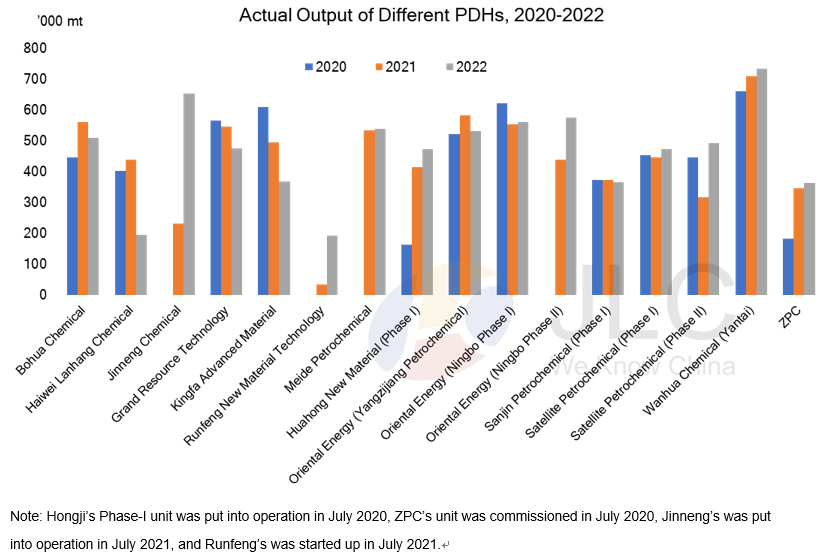

In 2020, China's total feedstock demand from PDH units stood at 6.03 mln mt, an increase of 15% year on year. As the maintenance period of some PDH units was longer than that in 2019 because of COVID-19 and other factors, throughput was down compared with a year earlier. Nevertheless, two new PDH units were put into operation during the same year.

In 2021, China's total feedstock demand from PDH units hit 9.30 mln mt, a sharp increase of 54% from 2020. In the year, the maintenance period was shorter than the level in 2020 because of healthier margins H1 2021. In addition, another two PDH units came online in the same year.

In 2022, China's total feedstock demand from PDH units reached around 9.60 mln mt, up 12% year on year. As of 2022, China had commissioned 21 PDH units in total, with a combined capacity of 11.78 mln mt/yr. In the year, China saw five new PDH units coming on stream, the highest number in three years, with a combined capacity of 2.4 mln mt/yr.

As for regional demand, East China’s demand for propane was significantly higher than that in other regions, accounting for over 60% of total domestic demand. This was largely because propane, the feedstock to PDH units, came mostly from import, and East China simply had more ports. Feedstock gas could be pumped to the producers directly and the cost was significantly lowered as a result. Therefore, coastal areas had higher demand for propane than inland regions.

In terms of run rates, China’s PDH units were operated at 80.45% of designed capacity in 2020, down 4 percentage points year on year. At the beginning of the year, PDH units began to shut down for maintenance because COVID epidemic had severely affected production and people’s livelihood. However, driven by the demand for masks amid COVID, utilization of PDH units began to pick up fast and remained at high levels later in the year, as PDH units produced raw materials required for mask production. In 2021, the operating rate stood at 78.19%, down 2 percentage points year on year. Due to maintenance and load cuts, and also because producers kept their new units at low capacity in early stage of production, coupled with "dual control of energy consumption" by the State, China’s PDH runs hovered at low levels throughout the year. In 2022, China’s PDH utilization averaged 69.35%, a decrease of over 8 percentage points year on year. The drop came as some producers planned more turnarounds and postponed restart time due to negative margins, and some new units entered maintenance frequently due to unstable status during the early stage of production. As a result, runs fell considerably on a year-on-year basis.

As for profitability, average margins of domestic PDH units in 2020 were CNY1,136/mt, down 21% year on year. Profits plummeted at the beginning of the year amid COVID, and rebounded later in the year, driven up by robust demand for masks, a downstream end-product of PDH units. In 2021, margins of domestic PDH units averaged CNY516/mt, a dive of 55% from the year before. In the first three quarters, margins were healthy due to strong demand for masks, but in Q4 2021, economics began to plummet because of higher cost and sluggish demand due to the "dual control" policy on energy consumption. In 2022, margins entered negative territory, averaging minus CNY454/mt, down significantly by 188%. The slump in margins was attributed to higher propane prices in the wake of skyrocketing energy prices amid Russia-Ukraine conflict, coupled with flat prices of propylene due to ample supply.

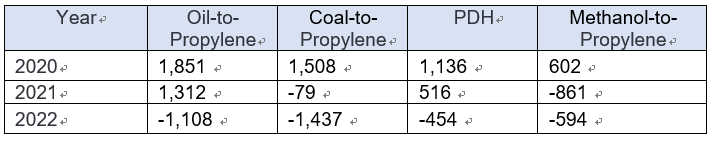

Propylene, the main product of PDH units, could also be produced with various technologies and different raw materials such as propane, coal, oil and methanol. Below is the comparison of average margins with different raw materials over the past three years. (CNY/mt)

In 2020, margins of producing propylene from the four mainstream raw materials were considerably high, with profits ranging around CNY602/mt to CNY1,851/mt, among which, oil-to-propylene was the most lucrative, as the table shows. Since 2021, however, margins of methanol-to-propylene and coal-to-propylene turned negative, while oil-to-propylene still enjoyed a sizable profit of over CNY1,000/mt. In 2022, margins dived into negative territory across the board. Oil-to-propylene was no longer economically viable and performed only better than coal-to-propylene. Propylene from PDH, although still stuck in negative margins, managed to cap the losses and outperformed the others. Margins of propylene production with different raw materials were directly linked to the prices of raw materials, as well as the price fluctuation of propylene itself.

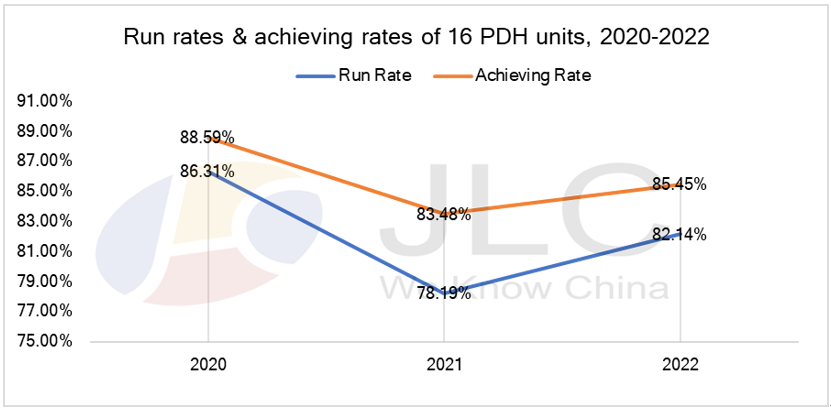

As is shown in the chart, JLC selected 16 PDH plants with relatively stable units for monitoring. From 2020 to 2022, the operating rate at these plants fluctuated along with PDH margins, and the market had experienced uncertain factors, especially the impact of higher costs and thinner margins. Propylene’s margins were low, but the profits generated from by-products could make up for some losses. On the other hand, thanks to the upgrading of PDH technology, the daily achieving rate and stability of the units had been improved. Therefore, as is shown in the chart, daily achieving rates of the 16 units edged up in 2022, after a decline in both run rates and daily achieving rates back in 2021.

Economics Analysis of PDH Units Using Different Technologies

There are two main PDH technology processes, one is Lummus's fixed-bed dehydrogenation technology Catofin and Honeywell's moving-bed continuous regeneration dehydrogenation technology Oleflex. Honeywell's technology is used in more than 60 percent of PDH units worldwide by the end of 2022.

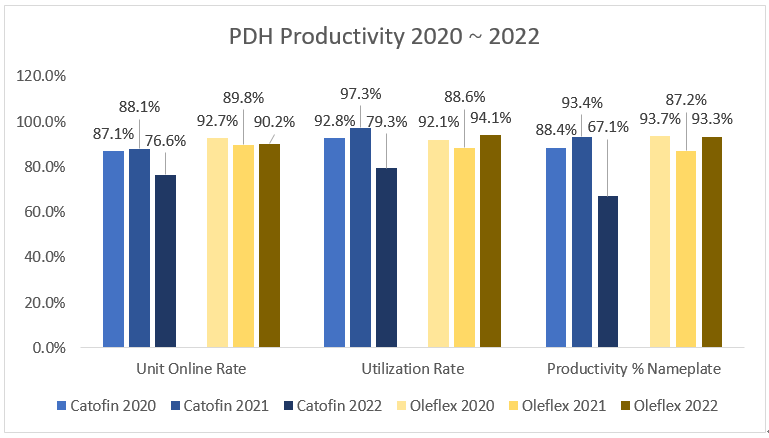

The following figure shows the key production and operation indicators of fixed-bed and moving-bed PDH production process units from 2020 to 2022.

Unit Online Rate refers to the percentage of annual running days divided by 365 days in a year of different PDH technology process units. This is a comprehensive index to evaluate the PDH unit operating stability, the frequency and duration of maintenance, and the operation and shutdown status affected by market fluctuations. Fixed-bed PDH units had relatively stable operating hours in 2020 and 2021, while downtime increased significantly to averagely 85 days in 2022 due to the market downturn and lower profitability of PDH units. Moving-bed PDH units have been operating stably over the past three years, average downtime was around 35 days every year.

Utilization Rate is the ratio between the actual average daily propylene production and the designed daily production during the operating days, which indicates the operation stability and production efficiency of the unit. Utilization Rate of fixed-bed PDH units in 2021 increased by 4.5 percentage points compared with that in 2020, mainly because of the successful new startup of Jinneng which is using the latest generation PDH fixed-bed Catofin technology, and the good equipment conditions and high throughput of Tianjin Bohua and Juzhengyuan units after maintenance. However, in 2022, due to key equipment failure and downturn of the PDH market, the run rate of fixed-bed PDH units decreased significantly. The utilization Rate of moving-bed PDH units decreased by 3.5 percentage points in 2021 comparing to 2020 average rate, mainly because several new units started up in 2021, and per the feature of moving-bed PDH technology, the initial start-up procedure requires a long period of time at a relative low throughput to establish catalyst circulation and it takes time to ramp up production, which reduces the average utilization rate of moving-bed PDH units. In 2022, operation was improved with the improvement of moving-bed PDH technology that significantly lowered the requirements of low throughput during unit startups, an improved catalyst system and increasing proficiency in technology. The utilization Rate of moving-bed PDH units rose a lot in 2022.

The percentage of actual annual olefin production and nameplate of production of PDH unit is a comprehensive indicator considering the unit operation and start-up efficiency, and is the actual propylene production finally achieved by the different units considering the different technology feature and maintenance requirements, as well as the stability of the unit, and the fluctuation of the upstream and downstream of the market and PDH units profitability. In 2020 and 2021, this ratios were very relative in both fixed-bed and moving-bed PDH units, which were 90%. As the profit of PDH units changed from positive to negative due to the increase of propane price in 2022, the production rate of PDH units using fixed-bed PDH technology decreased significantly compared with the previous two years, while the production rate of moving-bed PDH units remained at a high level in the same year.

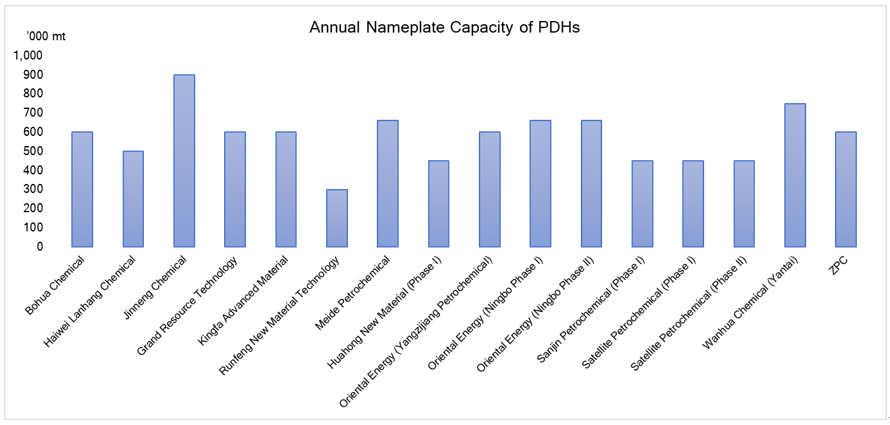

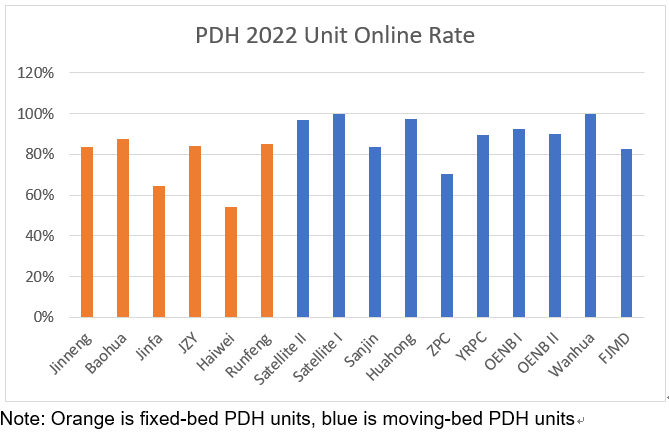

As shown in the figure below, the annual Unit Online Rate of all PDH units in China in 2022, the shutdown statistics used in calculation includes planned maintenance, unplanned maintenance due to equipment failure and shutdown due to declining market profitability. Six PDH units (Orange) using fixed-bed technology had an average downtime of 85.4 days in 2022, with an average of 3.2 shutdowns. In 2022, there were ten moving-bed PDH units (blue), with an average downtime of 35.8 days and an average 1.1 shutdowns, among which no downtime was observed in Yantai Wanhua and Satellite No.1 PDH unit. In 2022, almost all PDH units were scheduled for turnaround or maintenance. The main reason is that since the end of 2021, with the increase of propane price, the production profit of PDH had declined significantly, and the production margin became negative. Under the unfavorable market environment, most units had advanced the planned turnaround from 2023 to 2022. Then the units will be in good condition after maintenance, and they are expected to achieve high throughput and uninterrupted stable operation after the market recovers in 2023.

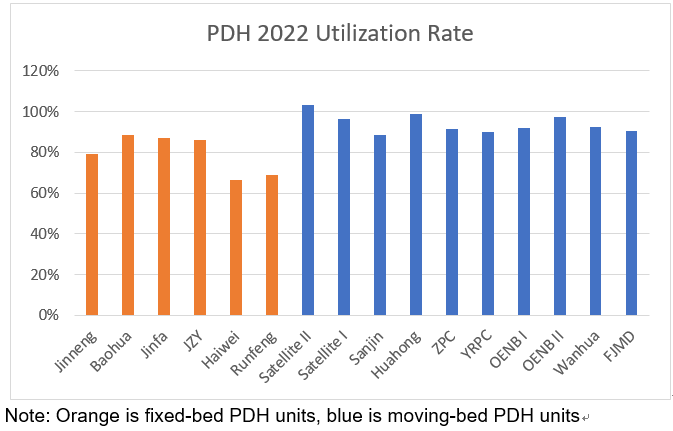

The figure below shows the average Utilization Rate during on-stream period of all PDH units in China in 2022. The average rate of fixed-bed PDH units was 79.3%, and that of moving-bed PDH units was 94.1%.

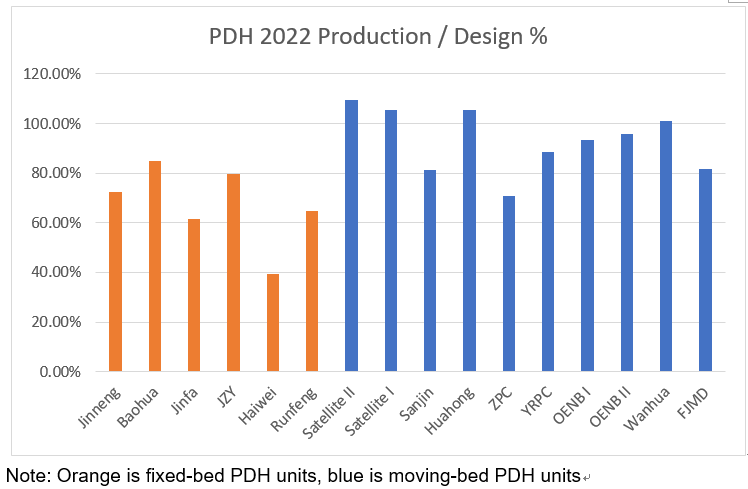

Below figure is comparison of actual annual olefin production and nameplate production of PDH units in 2022. The actual propylene productivity of fixed-bed and moving-bed PDH units in 2022 was significantly different mainly because of the characteristics of two different technologies.

Fixed-bed PDH technology has a number of fixed-bed reactors, typically 8 ~ 10 reactors, through high temperature sealed cut-off valve to achieve continuous switching of propane, propylene, hydrogen, oxygen and other materials in a single reactor, to achieve the smoothly switch between reaction and regeneration. Typically, the fixed-bed reactor has a great design margin, in order to achieve higher throughput. At the same time, when a single reactor glitches, it can be taken offline for maintenance, which does not affect the operation of other reactors, and that provides a certain flexibility for the fixed-bed PDH plant.

Moving-bed PDH production technology has 4 dehydrogenation reactor in series, through the catalyst circulation between the reactor and the regenerator for achieving dehydrogenation reaction and catalyst regeneration. Reactor and regenerator do not need to carry out a large scale of rise and fall the temperature and material switching, reactor and regenerator temperature and pressure are relatively steady.

Based on the characteristics of two different PDH technologies, fixed-bed PDH and moving-bed PDH both have advantages. The fixed-bed units can achieve high throughput operation, maintenance easier and good flexibility, while the moving-bed unit has lower propane consumption and utility consumption, strong operation stability, but lack of flexibility. Therefore, as a result in 2021, propylene production margin of PDH units was high and the overall utilization rate of fixed-bed PDH units was quite high. However, in 2022, the raw material propane had been maintained at a high price range of 5,000 ~ 7,000 RMB/MT throughout the whole year, which increased raw material cost significantly. The propylene production margin of most PDH units turned negative, and it was difficult to achieve positive profit. In such market environment, almost all the moving-bed PDH units still had high productivity mainly because of their lower feedstock and utility consumption. Per the list price of propane in 2022, every 1% reduction in raw material consumption achieved a reduction of about 60RMB/MT in the raw material cost of PDH production, and every 1% reduction in utility consumption achieved a saving of 20RMB/MT. Due to the continued high propane price in 2022, most fixed-bed PDH units operated below the break-even economic point and were forced to reduce production or shutdown, while moving-bed PDH units had production advantages of lower cash cost, enabling them to maintain a certain level of profitability in 2022, which resulted in relatively high production at moving-bed units.

We hope that through the analysis of the market changes in 2020 ~ 2022 and the operation of different PDH units, we can help you make a more accurate judgment when you are considering investment in the PDH industry. We hope that investors can consider the different feature and performance of different PDH production technologies and choose a more suitable technology for investment based on the actual layout of their complex, so that they can better meet the challenges brought by market changes.

PDH Projects Under Construction

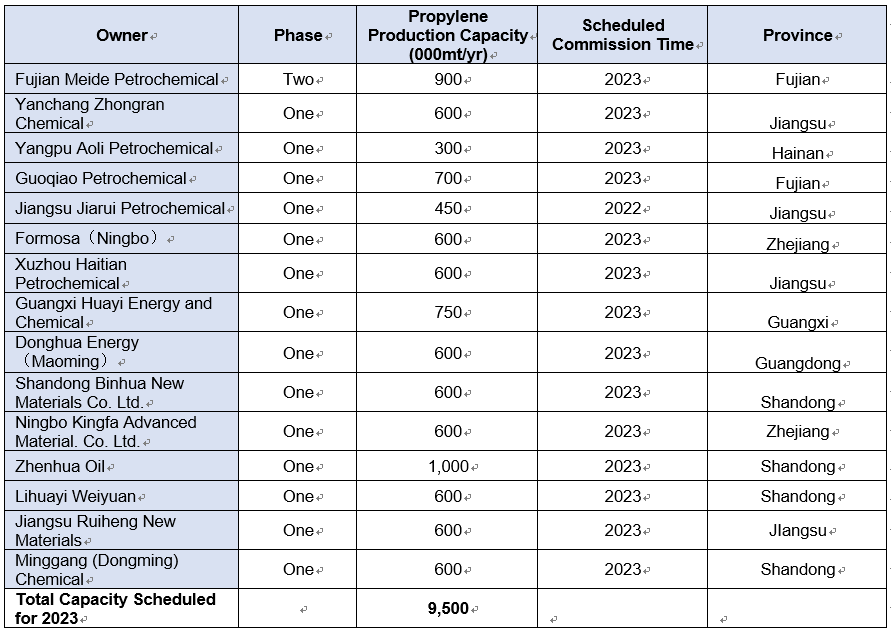

As propane prices continued to fall at the end of 2022, PDH margins once again returned to positive territory. Meanwhile, there are still a number of PDH units that are scheduled to come on stream in 2023. The following are the PDH units that are planned to be put into operation in 2023, according to JLC’s statistics.