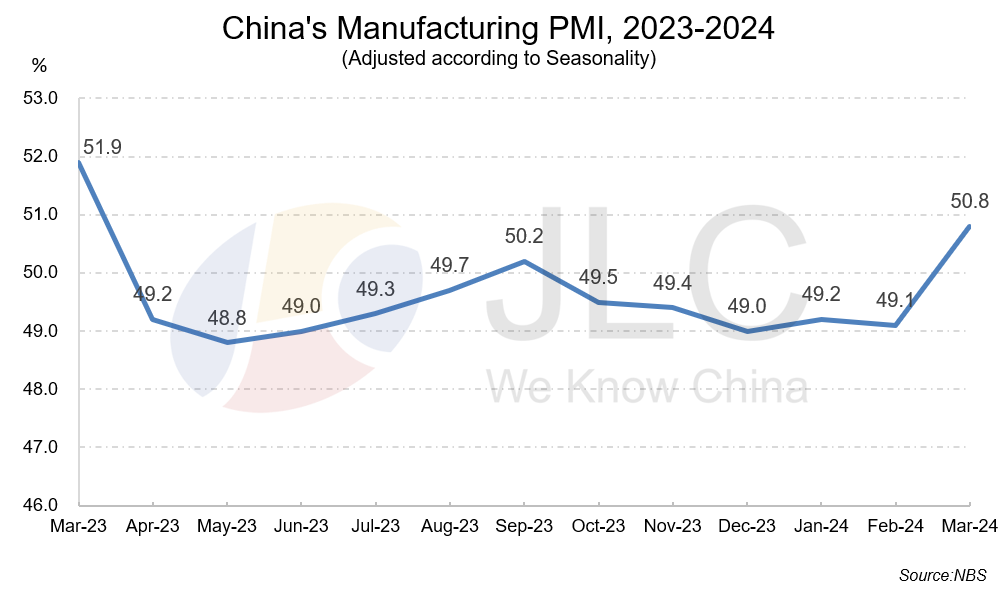

Guangzhou (JLC), April 1, 2024 – China's manufacturing purchasing managers' index (PMI) rebounded to expansionary territory in March after five months of contraction, data from the National Bureau of Statistics (NBS) showed.

The manufacturing PMI gained 1.7 percentage points month on month to 50.8% in March, the highest since March 2023 when the gauge stood at 51.9%, suggesting that the manufacturing sector is gathering steam.

The upbeat result followed recent better-than-expected export and retail sales data for January-February.

The upbeat result followed recent better-than-expected export and retail sales data for January-February.

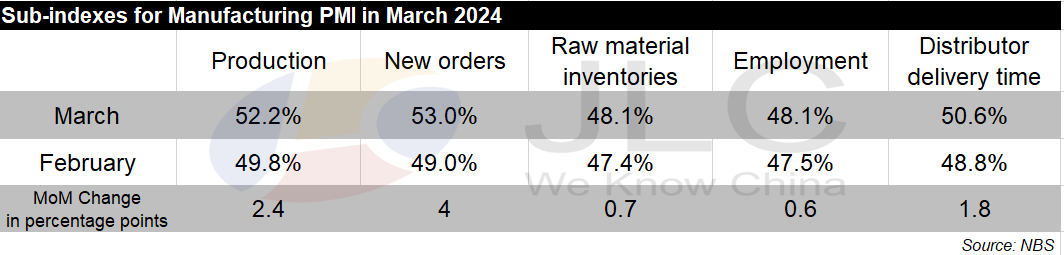

A breakdown of March’s manufacturing PMI showed that the sub-index for production stood at 52.2%, a month-on-month rise of 2.4 percentage points, signaling that the production activities rebounded strongly to expansion.

The sub-index for new orders surged to 53.0% in March, indicating that the market demand improved considerably, the NBS data showed.

Meanwhile, the sub-index for raw material inventories came in at 48.1%, up 0.7 percentage points month on month. The sub-index for employment and for distributor delivery time stood at 48.1% and 50.6%, up 0.6 and 1.8 percentage points, respectively, from the previous month.

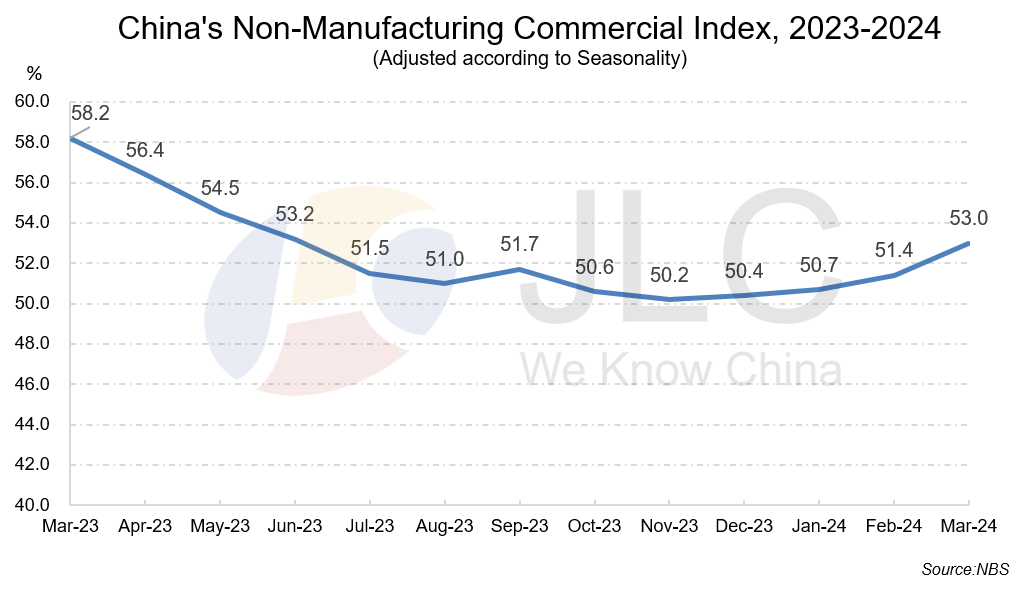

Non-manufacturing index extends gains

China’s non-manufacturing commercial index came in at 53.0% in March, up from 51.4% in February, suggesting that the non-manufacturing sector expanded at a faster pace, the NBS data indicated.

The commercial activity index for construction stood at 56.2%, up 2.7 percentage points month on month. The commercial activity index for services came in at 52.4%, up 1.4 percentage points from the previous month, the NBS data showed.

The commercial activity indexes for postal, telecommunications, broadcasting and television, satellite transmission services, monetary and financial services, and capital market services were all above 60% in March, suggesting high prosperity for these sectors.

However, the index for the property sector was still below the 50% mark, the NBS said.