Beijing (JLC), September 16, 2025--JLC successfully concluded its 14th Oil Seminar in Singapore on September 9, which focused on the latest changes and opportunities of China’s oil industry.

The event attracted numerous industry participants from refining, trading, finance and consulting sectors. JLC also invited its partners GME and Gulf Intelligence to share their valuable insights from an international perspective.

Victor Yang, Senior Analyst at JLC International, firstly shared his insights into China’s oil product market, highlighting the resilience of domestic refiners in navigating the trade war and potential supply disruptions in 2025. In the first seven months, throughput of Chinese refiners and crude imports saw modest growth. However, domestic apparent consumption of gasoline, diesel and jet fuel showed a downward trend. Over the same period, major refiners adjusted their export pattern by lowering gasoline and diesel exports and raising jet fuel exports. On the policy front, new measures like the New Regulations on Oil Product Circulation, Anti-Rat race Policy and closed-off operation of Hainan Free Trade Port were introduced to regulate the market and foster long-term development.

James Lear, acting head of products and services at GME, delivered a speech on the dynamics of the sweet/sour crude spread and its effect on the East of Suez market. Starting from drivers shaping the spread in 2024-2025, he systematically analyzed the structural challenges faced by the market, and provided a forward-looking outlook on the market trend.

Sean Evers, Managing Partner of Gulf Intelligence, discussed the global macroeconomic landscape after three quarters of Trump's second term.

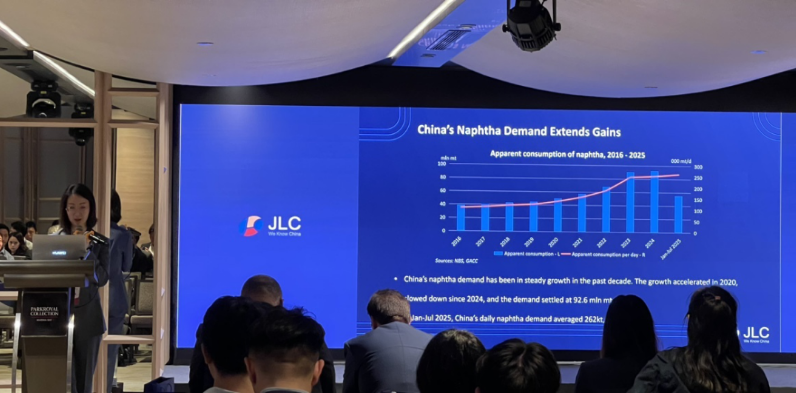

Xie Yu, Chief Editor at JLC International, shared the supply and demand pattern, market dynamics, and future trends of China's naphtha and biofuel industries.

Over the past decade, the growth in China’s naphtha demand leveled off after experiencing a surge. Naphtha supply was also on the rise due to the higher yields at refineries and increasing imports. In Jan-Jul 2025, daily imports jumped 32.3% year-on-year to 43,900 mt, hitting a historic high. Capacity of steam crackers and reformers continue to expand, but profits are not optimistic. Looking ahead, with the commissioning of new units, naphtha imports are expected to remain on an upward trajectory from 2026 to 2028 and reach 2.5 million mt in 2028. The entire industry chain will face fiercer competition among domestic producers and pressure from cost reduction and technology upgrade.

China's biofuel industry is currently in a period of strategic transformation. Given changes in tax rebate policy and new industry regulations, China’s UCO exports showed different pattern in 2025. Exports to US plummeted by 60.6% year-on-year and volumes to others destinations (Europe, Korea and Southeaster Asian countries) increased by 33.4%. China’s SAF industry saw rapid growth. In the first seven months, the output of biodiesel (FAME, HVO, SAF) increased by 50% year-on-year to nearly 1 million mt, with SAF surging by over 150%. However, feedstock shortages remained a prominent challenge, with hogwash oil prices breaking through the historic high of $1,100/mt in late July. It is projected that SAF exports will further increase in 2026, and domestic demand will expand amid the implementation of the national action plan in 2026-2027. Under the guidance of policies and both domestic and international markets, feedstock compliance is also expected to strengthen.

China's energy industry is shifting from unit expansion to quality upgrading, and from traditional fuels to green and low-carbon energy. Against the backdrop, domestic refiners need to enhance their independent mastery of core technologies and bolster industrial chain resilience through international cooperation to achieve a win-win result for economic and ecological benefits.

The JLC Oil Seminars serve as a platform that bridge the global wisdom and local practice, on which we offer advanced insights into China’s energy market with accurate data and deep analysis to assist participants in decision-making.

As a leader in digitalized and intelligent service in China’s bulk commodity market, JLC provides participants with comprehensive solutions for policy analysis and supply chain optimization on the basis of its global energy market database and professional analyst team. The successful hosting of the seminar empowers energy industry players better identify emerging opportunities in a rapidly evolving market landscape.